Duty Free World Council report highlights increase in impulse purchasing

The Duty Free World Council (DFWC) has reported that impulse purchasing in global duty free has shown a 2% increase since the previous quarter, according to the Council’s quarterly KPI Monitor.

The Monitor, produced for the DFWC by leading industry research agency m1nd-set, for Q1 2024 reveals that the number of impulse buyers rose by 2% from 26% in Q4 2023 to 28% in Q1 this year. It also shows a moderate decline in planned purchasing with undecided planners, (i.e. those shoppers who plan their purchases with either some idea or no specific idea in mind of which product they wish to purchase) falling 2% to 41% in this last quarter.

There was no change in the percentage of specific purchase planners between Q1 2024 and the previous quarter, which remained at 30%.

Drivers and barriers to purchase are identified in the report

Purpose of purchase also changed moderately between Q1 2024 and the previous quarter with an increase in self-indulgence and a decline in gift purchasing. Self-purchases increased by 2% from 49% to 51% in Q1 this year, while gift purchases fell by 2 points from 27% to 25%. Purchases for sharing increased by 1% over the same period.

Touch points, whether physical, digital, or human are also monitored and reveal highly actionable data, according to Peter Mohn, m1nd-set CEO and Owner. He said, “The influence of sales staff and the engagement level with customers in the store are perhaps among the most interesting and actionable performance indicators we study in the monitor, as staff engagement has a direct influence on the customers’ decision to purchase. When staff are motivated to interact with customers and engagement levels are high, we generally see a positive influence of staff interactions. This is the case for Q1 this year where we see an increase over Q4 in both criteria.”

Staff interaction rose by 3% to 50% in Q1 2024, and the positive influence of the interaction rose four points from 69% to 73% over the same period. “The fact that unplanned impulse purchases also increased between the last two quarters is no coincidence, as staff are instrumental in influencing the purchase decision and converting browsers into shoppers,” Mohn added.

The latest KPI Monitor detailed international pax departures

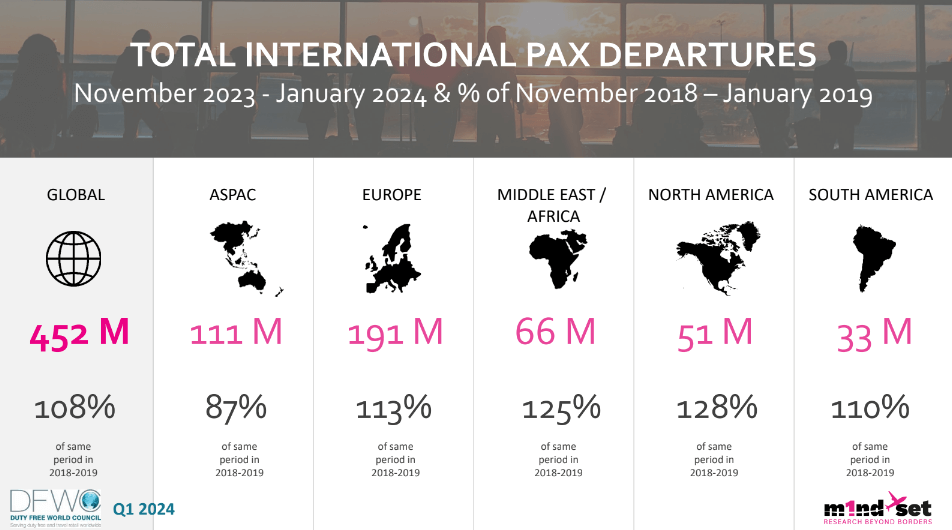

The DFWC KPI Monitor traffic analysis, which compares international passenger departures between November 2023 and January 2024 to the pre-COVID era of November 2018 and January 2019, shows a healthy traffic revival on average, albeit with some considerable variations across world regions. Globally, air traffic during the three-month period was at 108% of the 2018-2019 level, with 452 million international passengers. The only region not to have arrived at, or surpassed, the pre-COVID level is Asia Pacific where international traffic in the region reached 87% of the pre-pandemic period, with 111 million international departures. North America and the Middle East & Africa regions both surpassed the pre-Covid traffic levels by a significant margin.

International departures between November 2023 and January this year in North America stood at 128% against the same period between 2018 and 2019 with 51 million departures. The Middle East & Africa with 66 million departures was at 125% of 2018/19 levels. The third strongest growth was seen in Europe where international passenger departures were at 113% of the pre-pandemic period, but Europe posted the highest passenger volume with 191 million departures. South

America follows in fourth place at 110% and the lowest overall volume in international departures with 33 million outbound passengers during the 3-month period.

Sarah Branquinho, DFWC President, commented: “International traffic is now well on the way to a full revival across the globe in 2024, and Asia Pacific is set to join the other regions with a return to pre-pandemic levels. The long-awaited return of the Chinese travelers is finally here also, as Chinese travelers are now among the top ten nationalities for international departures. The industry needs to be ready to greet them and meet their expectations with renewed innovation, exciting experiential retail, and customer service that is second to none. The profile of the Chinese traveler has evolved since the pre-pandemic period, with a greater proportion of younger travelers who will be discovering some destinations, and the travel retail offer there, for the first time. All industry stakeholders must ensure the product offer and on-floor sales staff create a positive experience to ensure that travel retail is firmly on the radar of these new travelers as a shopping destination not to be missed.”